Kate Woosey, Financial Adviser, and Founder of financial advice service Alex, looks at how to plan for lumpy income.

Working for yourself often comes hand in hand with irregular income (so-called lumpy income) and you may go through boom and scarcity periods. While some creatives may be able to count on regular clients more often than not, you’ll be looking at a lumpy income — and that is ok — but at the same time can cause a lot of anxiety.

This uncertainty can be a major contributor to stress and can lead to mental health issues if not managed properly. We have a lot of emotional and social value tied into our relationship with money and it can often lead to acute stress, even when you may not be aware of it yourself.

Thankfully, there are steps you can take to help you quantify the boom and bust periods so you can be best placed to deal with these changes when they come. In this instance, I find that when I’m working with creative freelancers (or anyone working for themselves) cash flow modelling is a key tool in determining your holistic financial health. Helping to quantify in real terms when you have excess and when you may need to dip into those savings to get by. Once you work this out, you can then build in your budgeting, and how much you need to pay yourself per month.

How to make a cash flow:

Work out your net income

The first thing you’ll have to do is to work out your net income, this is your total income minus business expenses with tax deducted.

Online calculators work out your tax and net income for you and split this into individual months, or you can do it yourself – but remember to take off your tax-free personal allowance of £12,500 or £1,042 p.m.

If you have been trading for a year, look at your past performance and let this guide you on your future goals. As the first few months are typically slow, try to build in what this would look like now and add in any growth you expect in the year ahead.

Likewise, if you are just starting, use a general projection that you believe you can hit, you can edit this as you go and also go back to your cash flow to add in your real values at the end of the month.

Know your baseline

Now work out your committed expenditure, this includes things like your rent, utilities, insurances, savings and food – then block this out as your minimum spend.

To help guide you I’ve created a budget planner which you can download for free by signing up to my newsletter.

Now work out what you spend on extras

Then add in your typical expenditure per month and add this to your committed costs to use this as a baseline of spending.

This is not a budgeting plan, so no need to be precise to the pound here, but aim to work out what you are spending in an average month on those non-essential items.

Make regular savings contributions

Within this model, where possible, aim to build in regular savings contributions to see where you come up. Aim to make automatic savings so it almost becomes an essential spend.

Remember to keep this in a quick access account at first, while you build up that cash safety net.

Prioritise your work benefits

In employed work, having a good financial support system in place can be a huge driver in employee wellbeing; when self-employed it is up to you to create this for yourself. I cannot stress enough the importance of doing so, yet many freelancers put this off, causing added worry.

This means looking at a pension, and insurances such as income protection, critical illness, and if you’re feeling flush, private medical insurance. If you have dependents, it is also wise to add in life cover (this is often called death in service).

If you need to reduce your savings or expenditure each month to build in space for protection, do it. If that rainy day does come, protection will pay out more than you could have saved, and it is more worthwhile than a Prêt lunch.

Now it’s time to look at cash flow modelling

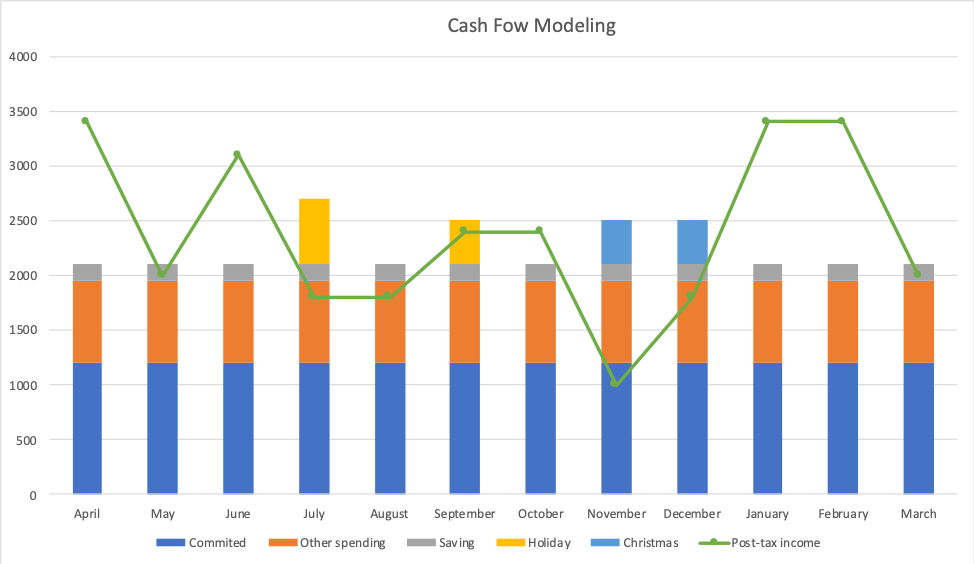

If you have multiple income streams you may wish to use the blocks to break down income sources, using the line to show expenditure instead. For this model, I would like to highlight different types of spending.

Cash flow modelling will give you a quick overview of where your boom and bust periods are, so you can plan ahead. This model does not need to be precise to the nearest pound but use it as a rough guide to help quantify the natural flow of your income and expenditure.

If you look at the example above even though there are months when you spend more than you earn, which can often be stressful, especially if you are barely making enough to pay for your committed expenditure. However, with cash flow modelling you can review your income holistically, and actually when looking at the example above, over the year you have £1,500 extra coming in from your business.

If you are a limited business you may have the benefit to leave the money in your business until it is needed and pay yourself enough to cover your regular spending, however, if you are a sole trader, it will be classed as income earned that tax year.

It’s important to pay yourself a set salary each month, keeping the remainder in your business account to dip into when needed. You may also wish to place it into an instant access savings account to accrue interest while having the reserves liquid — meaning they can be accessed quickly if needed.

Remember it’s a living document!

Your cash flow model shouldn’t be created and then forgotten about. Try to update this with your real figures each month and do a complete deep dive each year. This will help give you financial clarity.

If you would like more information on how to create a cash flow model or to talk through any of your financial issues, book a discovery call with me to see how I can help you regain control of your finances.

Kate Woosey, Financial Adviser, Alex

www.alexfs.uk

Kate Woosey is a financial adviser who set up Alex to provide financial support for freelancers and small business owners to help them engage with their money.

After working in the design industry for eight years, Kate decided to retrain as a financial adviser after seeing a lack of advice that was available and relevant to her as a freelancer. Today, through Alex, Kate offers zero jargon, relatable advice for individuals and businesses, focusing on education, 1-2-1 conversations, and proactive work to increase financial security and wellbeing at any stage of life.